How to calculate tax savings in stone field price survey

.jpg)

15818 Pricing Lecture Notes, Measuring Customer Reactions to

In this lecture we learn both how to price new products by using survey tools, and how to improve pricing of existing products by measuring price elasticities Table 1 Price Measurement MatrixStudents must ensure that they can calculate tax savings using different tax regimes For instance the next problem you face may have tax allowances granted on a straightline basis and the ADVANCED INVESTMENT APPRAISAL ACCA Global2018年11月1日 Students will perform an analysis of mutual fund transactions using four permissible methods for determining cost basis Students will use a formula based approach Modeling investment tax planning with Excel The Tax AdviserOur FREE Cost Segregation Savings Calculator estimates your federal income tax savings and provides: Estimated allocations to 5, 7, 15, and real property Tax deductions and additional Savings Calculator Cost Segregation Studies Tax Calculator KBKG

.jpg)

The Best Method of Calculating Depreciation for Tax

2024年9月9日 The straightline method is calculated by subtracting the salvage value from the asset's purchase price and then dividing the resulting figure by the projected useful life of the 2024年1月23日 Cost modeling and optimization tools allow you to systematically track your procurement savings by analyzing and optimizing expenses These tools can also provide a How to Measure Cost Savings in Procurement Veridion2024年9月3日 Indirect costs include costs such as taxes, administrative fees, financing costs, professional fees, and insurance There are four main methods to estimate cost new when The Cost Approach to Real Estate Valuation PropertyMetrics2023年9月28日 To get an accurate cost estimate for a geophysical survey, it is recommended to contact multiple geophysical survey companies or consultants, provide them with specific Geophysical Surveys: Cost Factors Uses Rangefront Mining

How to Calculate Sales Tax, With Examples Investopedia

2024年10月30日 Here’s how to calculate the sales tax on an item or service: Know the retail price and the sales tax percentage Divide the sales tax percentage by 100 to get a decimal 2016年10月1日 Use this calculator to find out the amount of tax that applies to sales in Canada Enter the amount charged for a purchase before all applicable sales taxes, including the Goods and Services Tax/Harmonized Sales Tax (GST/HST) and any GST/HST calculator (and rates) Canadaca2023年9月29日 4 Calculate the Sales Tax: To calculate the sales tax on a purchase, multiply the purchase price by the total sales tax rate as a decimal For example, if you're buying a $100 item in an area with a 7% sales tax rate, you How to Calculate Sales Tax in the USA: A 2024年10月30日 The final price of the item is the amount of tax plus the original price of the item before tax 35 The number of states, plus the District of Columbia, that have a sales tax of 5% or higherHow to Calculate Sales Tax, With Examples

TradeIn Sales Tax Savings Calculator Find The Best Car Price

In 41 states you can get a tax credit in when you tradein your car if you buy another at the same time This can be a reason to tradein at the dealership as long as you're not getting a lowball offer The tradein calculator below will tell you your potential tax savings and help you decide whether you will make more money tradingin to a dealership or selling to a private party2023年10月27日 But with the right approach and guidance, oil and gas can offer a rewarding addition to your portfolio, both in terms of potential returns and tax advantages Maximize your tax benefits from oil and gas investments Tax laws and regulations can change quickly, so it’s important for investors to stay on top of the latest developmentsTax Benefits of Investing in Oil and Gas: A Detailed Overview4 天之前 Estimates Based on Survey Type and Your Location The survey cost calculator below returns an estimated cost of what you can expect to pay for the most common types of land surveys used by homeowners in residential applications Costs are based on the land survey type, and local variables based on your locationLand Survey Cost Calculator CostimatesTax Savings Calculator Donating longterm appreciated assets can result in a reduced tax bill while also increasing your ability to support your favorite charities Donating securities to charity, as opposed to selling and donating the proceeds, enables you to avoid capital gains tax and qualify for a charitable tax deduction for the fair market value of the securitiesTax Savings Calculator T Rowe Price Charitable

.jpg)

Tax on savings interest: How much tax you pay GOVUK

Personal Allowance You can use your Personal Allowance to earn interest taxfree if you have not used it up on your wages, pension or other income Starting rate for savings You may also get up But, first, do the calculation of Tax Shield enjoyed by the company Based on the information, do the calculation of the tax shield enjoyed by the company The following is the Sum of Taxdeductible Annual repayment=Equipment price * Interest rate * / = $30,000 * 10% * ÷ = $ These savings eventually add to the Company's bottom lineTax Shield Formula Step by Step Calculation with ExamplesThe Rectangular Survey System is basically a grid of lines based upon a true meridian and is originated from an initial point To begin the grid, the surveyor establishes an initial point from which to begin surveying From the initial point, the surveyor extends a northsouth line called a Principal Meridian and a Base Line running east BLM Module 2: The Public Land Survey System Study Guide2017年4月6日 Estimate how much Income Tax and National Insurance you can expect to pay for the current tax year (6 April 2024 to 5 April 2025)Estimate your Income Tax for the current year GOVUK

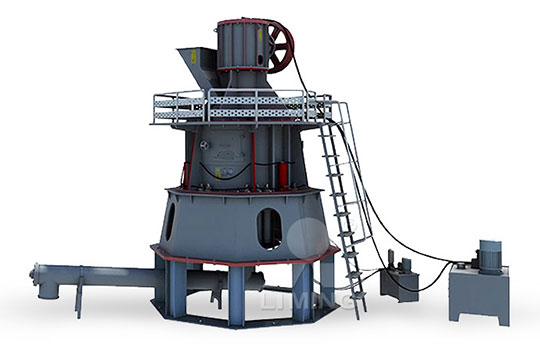

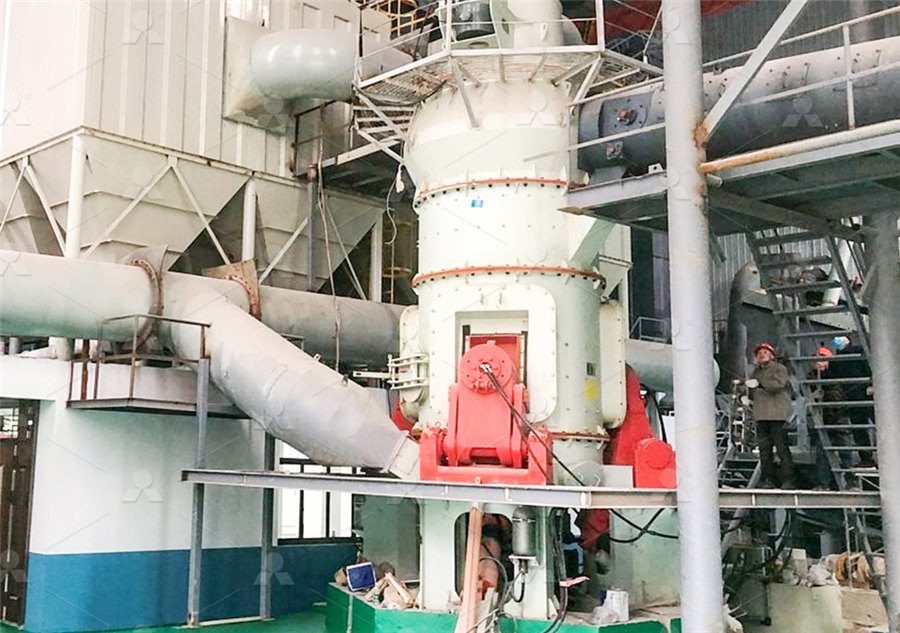

CFB石灰石脱硫剂制备64.jpg)

Savings Calculator Cost Segregation Studies Tax Calculator

Learn about the cost segregation savings calculator designed to show commercial property owners how much they can save on a study KBKG Tax Solutions 8775254462 CONTACT6 天之前 Next, we’ll edit the template to include different product option fields and include calculations to modify the Total Price field Step 4: Customize Form and Add Product Options By default, the billing/order form template has a How to Change the Total Price Calculations With Use our Tax Bracket Calculator to understand what tax bracket you're in for your 20232024 federal income taxes savings based on a comparison of TurboTax product prices to average prices set forth in the 20202021 NSA FeesAcctTax Practices Survey Report 1099K Snap and Savings and price comparison based on anticipated price Tax Bracket Calculator 20232024 Tax Brackets TurboTax® 2024年1月16日 Example Calculation of Private Savings Let’s consider an example to demonstrate how the formula for calculating private savings can be applied in practice Suppose we have a household with a disposable income of $5,000 per month and monthly consumption expenditures of $3,000 To calculate the private savings, we can use the formula:How To Calculate Private Savings Macroeconomics Livewell

.jpg)

How to Calculate Tax Savings Associated With Depreciation

Multiply the estimated depreciation expense by the corporate tax rate to calculate your tax savings associated with depreciation To conclude the example, if your corporate tax rate is 35 percent 2024年2月8日 You can now get your survey in front of more eyes than ever before, so you'll need to track these interactions carefully if you want to accurately calculate your response rate One option you can consider is customer feedback software , as many of these tools will have tracking codes and analytics that can record visits to your surveySurvey Response Rate: How to Calculate It (+ Tips to Improve ET money’s online salary calculator is fast and simple to use Following simple 5 steps will allow you to know your inhand salary Calculating takehome salary or net salary allows you to plan future spending, as it is directly dependent on income You can estimate your net monthly savings on the basis of inhand salaryIn Hand Salary Calculator 202425 Calculate Take Home Salary Save for pension from pretax income: pension needtoknows; 7Earn under £18,500/yr? Pay no savings tax: special savings allowance; 8Earn over £18,500/yr? Save taxfree in an ISA: top cash ISAs; 9Aftertax income impacts mortgage availability: ultimate mortgage calculator; 10Ensure you spend less than you earn: free budget planner; 11Income tax calculator: Find out your takehome pay MSE

.jpg)

3 Ways to Calculate Cost Savings Percentage wikiHow

2023年11月20日 Input new values in cells A1 and B1 to calculate cost savings percentage on other purchases Because you entered formulas into the other cells, Excel will automatically update the cost savings percentage when you change the original price or the final price, or both For example, say you also purchased a lamp for $10 that originally cost $172024年8月20日 You can efile income tax return on your income from salary, house property, capital gains, business profession and income from other sources Further you can also file TDS returns, generate Form16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax FilingLongTerm Capital Gains(LTCG): Tax Rates, How to Calculate, 2024年7月28日 This online sales tax calculator solves multiple problems around the tax imposed on the sale of goods and services It can calculate the gross price based on the net price and the tax rate, or work the other way around as a reverse sales tax calculatorThe sales tax system in the United States is somewhat complicated as the rate is different depending on the state and Sales Tax CalculatorCalculate your taxes under the new and old tax regimes in just a few simple steps using an income tax calculator! Mutual Funds All about Mutual Funds; Know your Investor Personality; Mutual Funds Home; Tax deduction of up to Rs Income Tax Calculator Calculate Taxes For FY 2024

Interest calculator UK How much interest will I earn?

You can work out how much tax you’ll pay on your savings interest using our savings interest calculator select what rate of tax you’re on and we’ll calculate how much tax, if any, we estimate you’ll have to pay on your interest Your PSA covers interest earned from: Bank accounts; Savings accounts; Credit union accounts; Building Calculate your federal taxes with HR Block’s free income tax calculator tool Answer a few, quick questions to estimate your 20242025 tax refund Overall tax savings will vary based on your Over 50% of our customers can save All tax situations are different Prices may vary by office and are subject to change Participating Tax Calculator Return Tax Refund Estimator Tool (202425)Estimate your tax refund or how much you may owe the IRS with TaxCaster tax calculator savings based on a comparison of TurboTax product prices to average prices set forth in the 20202021 NSA FeesAcctTax Practices Survey Report 1099K Snap and Autofill: Savings and price comparison based on anticipated price increaseTax Calculator Tax Refund Return Estimator 年8月18日 A pricing survey helps you determine how much people value your product and what they’re willing to pay for it Instead of guessing what price might be successful based on varying competitor prices or what seems like a fair markup on your product or service, pricing surveys can pinpoint your optimal price based on real data from your target customersHow to Conduct a Pricing Survey GroupSolver

Import Duty Calculator SimplyDuty

Calculate import duty and taxes in the webbased calculator It's fast and free to try and covers over 100 destinations worldwide Duty Calculator Import Duty Tax Calculations Use this quick tool to calculate import duty taxes for hundreds of destinations worldwide2024年1月16日 In this article, we will delve into the concept of tax savings when trading in a car We will explore how trading in a vehicle can affect your taxes, and the tax deductions that may be available to you Additionally, we will discuss the factors to consider when calculating your potential tax savingsWhat Is Tax Savings When Trading In A Car Livewell2024年1月23日 Measuring cost savings is a significant metric for the procurement department It’s the litmus test for costsaving strategies like strategic sourcing or tech adoption that shows whether or not these strategies bring tangible financial benefits to procurement Today, we’ll break down why you must track cost savings in procurement and how you can do itHow to Measure Cost Savings in Procurement Veridion2016年10月1日 Use this calculator to find out the amount of tax that applies to sales in Canada Enter the amount charged for a purchase before all applicable sales taxes, including the Goods and Services Tax/Harmonized Sales Tax (GST/HST) and any GST/HST calculator (and rates) Canadaca

.jpg)

How to Calculate Sales Tax in the USA: A

2023年9月29日 4 Calculate the Sales Tax: To calculate the sales tax on a purchase, multiply the purchase price by the total sales tax rate as a decimal For example, if you're buying a $100 item in an area with a 7% sales tax rate, you 2024年10月30日 The final price of the item is the amount of tax plus the original price of the item before tax 35 The number of states, plus the District of Columbia, that have a sales tax of 5% or higherHow to Calculate Sales Tax, With ExamplesIn 41 states you can get a tax credit in when you tradein your car if you buy another at the same time This can be a reason to tradein at the dealership as long as you're not getting a lowball offer The tradein calculator below will tell you your potential tax savings and help you decide whether you will make more money tradingin to a dealership or selling to a private partyTradeIn Sales Tax Savings Calculator Find The Best Car Price2023年10月27日 But with the right approach and guidance, oil and gas can offer a rewarding addition to your portfolio, both in terms of potential returns and tax advantages Maximize your tax benefits from oil and gas investments Tax laws and regulations can change quickly, so it’s important for investors to stay on top of the latest developmentsTax Benefits of Investing in Oil and Gas: A Detailed Overview

Land Survey Cost Calculator Costimates

4 天之前 Estimates Based on Survey Type and Your Location The survey cost calculator below returns an estimated cost of what you can expect to pay for the most common types of land surveys used by homeowners in residential applications Costs are based on the land survey type, and local variables based on your locationTax Savings Calculator Donating longterm appreciated assets can result in a reduced tax bill while also increasing your ability to support your favorite charities Donating securities to charity, as opposed to selling and donating the proceeds, enables you to avoid capital gains tax and qualify for a charitable tax deduction for the fair market value of the securitiesTax Savings Calculator T Rowe Price CharitablePersonal Allowance You can use your Personal Allowance to earn interest taxfree if you have not used it up on your wages, pension or other income Starting rate for savings You may also get up Tax on savings interest: How much tax you pay GOVUKBut, first, do the calculation of Tax Shield enjoyed by the company Based on the information, do the calculation of the tax shield enjoyed by the company The following is the Sum of Taxdeductible Annual repayment=Equipment price * Interest rate * / = $30,000 * 10% * ÷ = $ These savings eventually add to the Company's bottom lineTax Shield Formula Step by Step Calculation with Examples

BLM Module 2: The Public Land Survey System Study Guide

The Rectangular Survey System is basically a grid of lines based upon a true meridian and is originated from an initial point To begin the grid, the surveyor establishes an initial point from which to begin surveying From the initial point, the surveyor extends a northsouth line called a Principal Meridian and a Base Line running east